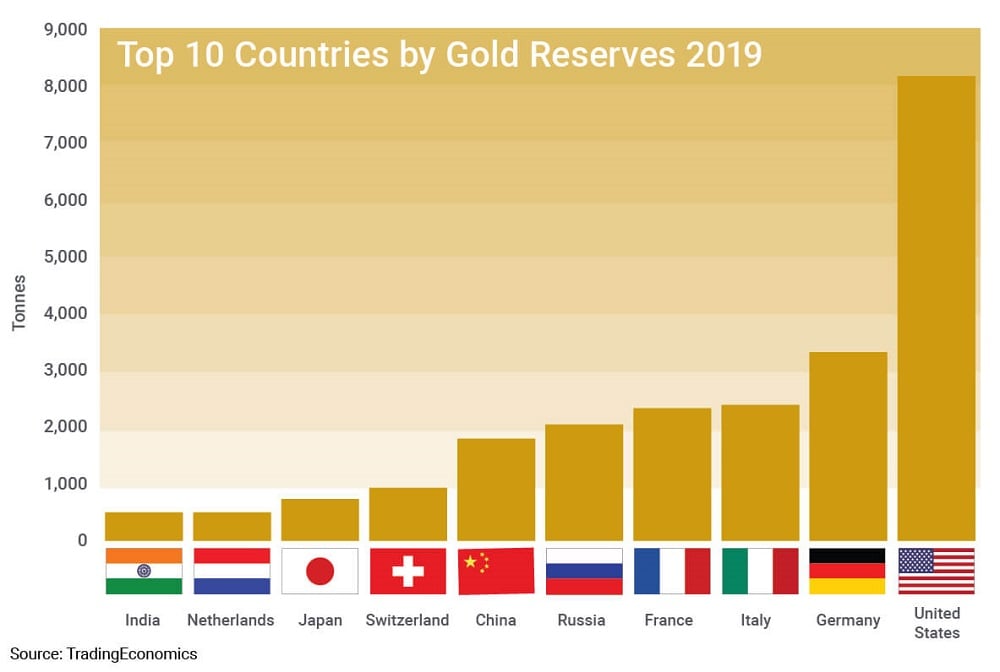

The United States of America

As per march in 2020, the USA holding gold around 8000 metric tons. The USA is the third-largest producer of gold and therefore, the single largest holder of gold reserves within the world. Previously, the United States’ gold reserve share was sixty-nine .5 %, with the physical stock reaching 8133.5 tons. Due to COVID-19, it brings down the numbers. This range has fallen within the last period from an associate incomparable high of over twenty,000 tons. In fact, for the past few years, USA gold reserves haven't modified the least bit, and it's one amongst the few countries on the highest ten lists to try to thus. With the biggest holdings within the world, the USA lays claim to almost the maximum amount of gold because the next 3 countries combined! It conjointly has one amongst the best gold allocations as a share of its foreign reserves, second solely to an Asian country, wherever the metal accounts for over 86%.

Germany

Germany As the second-largest holder of gold reserves in the world. Currently, it holds around 3409.3 tons of gold. Previous statistics show that Germany had 3,366.6 tons, making up 66 % of the country's foreign reserves. However, today, Germany has about 50 % of gold kept in Frankfurt and remaining in New York, the UK, and Paris in an emergency. In fact, in August of 2017, Germany’s central bank announced it had completed a program to repatriate gold bars worth nearly $31 billion from storage locations in New York and Paris. In total 743 tons were transferred. The bank said it was to help rebuild public trust and confidence and they are no longer worried about stopping their gold reserves from falling under Soviet control. There were rumors going around that the gold was actually missing and that the bars they were bringing in were fake. Outside tests were performed and the gold was ruled genuine. Germany’s got its gold back!

Italy

Italy has seen its share of economic issues within the last decade, and its high gold reserve proportion could be a symptom of the larger drawback. In fact, whereas European country appears to own stable, it hasn’t extremely done something associated with gold within the last few years. However, in foreign reserves, the European country has full-grown virtually. Previously, Italy’s foreign reserve quantitative relation Sat at sixty-five nada with the country holding slightly additional gold than France. Currently, European country remains stronger than France, holding 68% in foreign reserves. Today, the country holds a pair of,2451.8 tons of gold in reserve. Not like alternative countries, It has maintained the dimensions of its reserves over the years, and it's the support of European financial institutions (ECB) President Mario Draghi. The previous Bank of European country governor, once asked by a media reporter in 2013 what role gold plays in a very financial institution portfolio, Mario answered that the gold was " a reserve of safety,” adding, it provides you fairly smart protection against fluctuations against the dollar. So, whereas some would possibly see European countries holding onto their gold as being weak, there's a technique to the madness.

France

France is the 1st country on this list to interrupt a pair of,2000 loads of gold in reserve. The country presently holds 2435.7 tons. Many years ago the country sold-out over five hundred tons, then again set they'd slowly stop commerce gold over the approaching years. Previously, France has had the very best reserve proportion in gold investment, at 65 %. However, over the previous few years, the share has gone down despite the fact that the tons have raised. Today, the country sits at concerning 62% look after foreign reserves. Over the past few years, France’s financial organization has sold-out very little of its gold, and their calls to prevent commerce it all together. Marine autoimmune disorder Pen, President of the country’s reactions National Front party, has LED the charge not solely to place a freeze on commerce the nation’s gold however additionally to repatriate the whole quantity from foreign vaults and produce it all back to France.

China

China is the world’s favored producer of gold, and, however, little or now of that gold, is reserve for the country. Instead, most of it is sold, and also the profit is reinvested in Chinese markets. Within the coming back years, however, China appears to be increasing reserves of gold, to extend its foreign reserves. Many years ago, China commands, 1054.1 heaps of gold in reserve and had 1.7% in foreign reserves. Within the summer of 2015, the People’s Bank of China began sharing its gold buying activity on a monthly basis for a primary time since 2009. In December of that same year, the Renminbi joined the greenback, Euro, Yen, and Pound collectively of the International Financial Fund’s reserve currencies. This move needed China to fortify its gold holdings. Today, China is sitting sturdy with one,797.5 tons, and a couple of.2% foreign reserves. Reaching an all-time high of 1948.31 Tonnes in the fourth quarter of 2019 and a record low of 395.01 Tonnes in the second quarter of 2000.

Russia

Russia is the fourth-largest producer of gold within the world and has been increasing its own reserves since 2006 in order to diversify. Once a domestic purchase in 2012 of around seventy-five tons, the Russian gold reserve total reaches virtually 970 tons. This investment brings the foreign reserve proportion of up to nine.8 %. Ideally the goal is10%. However, Russia continued to steadily build up its gold reserves. In 2015, Russia was the highest customer, adding a record of 206 tons in its effort to diversify removed from the North American country dollar. As we tend to all recognize, its relationship with the North American country and Europe has grownup chilly over again since the annexation of the Crimean terra firma in mid-2014. To raise the money for these purchases, Russia oversubscribed a large proportion of its United States Treasuries. Today, Russia sits at concerning one,460 tons with V-J Day in foreign reserves. Russian gold reserves 900.74 Tonnes from 2000-2020, an all-time high of 2299.20 since the first quarter of 2020 and a low record of 343.41 Tonnes in the 2nd quarter of 2000.

Switzerland

Switzerland before 1997, the European nation was steadily building its gold reserves. In 1997, the choice was created to sell a number of those reserves to bolster land currency and diversify the foreign reserves. The percentage of foreign reserves in Switzerland is presently at 1.7 %. It really has the world’s largest reserves of gold per capita and presently has according to 1040 tons. Over time, many voters within the country began to want the bank was obtaining eliminate an excessive amount of gold. They then banded at the side of the “Save the Swiss” movement. However, once everybody was able to pick out 2014, the vote came to a no, and gold continues to be sold-out. Throughout war II, Switzerland became the middle of the gold trade Europe, creating transactions with each the Allies and Axis powers. Today, a lot of its gold commercialism is finished with the urban centers and China. Around last year, the land full-service banks created a $5.9 billion profit, reportedly from its gold holdings. Currently, Switzerland holds 1313 tonnes of gold reserve.

Japan

Japan is another country that had been increasing its gold reserves since the 1960s. Their official gold holdings were reported at 765.2 tons. About 2.4% of Japan’s gold today is in foreign reserve. Historically, Japan has always held a bit more gold than in other countries. This was true until 2011 when they began to sell some of their reserves in order to pump money into the economy after the tsunami and the following Fukushima nuclear disaster. But even with selling, Japan’s central bank has been one of the most aggressive practitioners of quantitative easing. For example, in January of 2016, it lowered interest rates below zero, which has helped fuel demand in gold around the world.

The Netherlands

Netherlands within the past few years, Holland has held 52% of its foreign reserve in gold. Holland encompasses a reportable 612.45 tons. In 2016, it had been reportable that the bank was trying to find an area to store all its gold as a result they were reaching to renovate the vaults and required to moving it. The Dutch financial institution is aiming to move the country’s gold reserves from the middle of the capital of The Netherlands to a brand new complicated referred to as the money Center. Like most countries, Dutch gold is additionally command in banks around the world to scale back risk. Security measures to protect the gold 24/7 became a retardant in the capita. The Netherlands 189,000 kilos of gold are going to be affected at the start of 2022. Perhaps this can be one reason that over the last decade, It was commerce-off a lot of gold scale back its reserve. However, there weren’t that several consumers out there, and that they oversubscribed, but the country wished. A lot of recently the country has had less ambition to sell gold. Currently, the country holds a similar quantity of tons, 612.45 that they need over the previous few years. However, the country has exaggerated its proportion of foreign reserves to 62 %.

India

India as per World Gold Council, the Banks of India presently holds 557.7 tons of gold. It's one in every of the most important stores of gold within the world! This makes up 9.9 makes the country’s total foreign reserve. Interchange reserves area unit cash or different assets reserves by a nation’s financial organization in order that they will back the national currency. India, home to 1.25 billion individuals, is that the largest client of the valuable metal. moreover, Republic of India is one in every of the foremost reliable drivers of world demand. For instance, India’s pageant and wedding season, which runs from Oct to Dec, has traditionally been a significant marketplace for gold. And possibly, one in every of the foremost attention-grabbing facts concerning in India and gold is that India seldom invests abundant in gold. This can be as a result of as a rustic, the Republic of India operates underneath the idea that purchasing gold leads toa deficit. And their belief should be proving right as things conjointly appear to be up for the Republic of India. For example, if you scrutinize the previous few years, the Republic of India has multiplied its gold reserves from 557.74 to 557.77. whereas this may not seem to be loads, the Republic of India is additionally at its highest purpose in history! additionally to what the country holds, Indian households that area unit thought-about the world's largest hoarders of gold, hold a record of twenty-three, 23000-24,000 tons, that is value concerning $800 billion.

Comments

Post a Comment

Feel free to contact me if you have any questions. Always ready to answer if I could not answer at that moment you just leave a mail to me, I will surely get back to you positively.